Qualifying Buyers and Sellers (Financial)

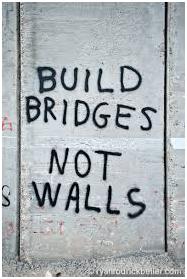

It’s impossible to help people when they are not open and honest. As advisors we need to really understand our client’s situation so that we can develop a successful buy or sell strategy. Building a trusting relationship is critical.

It’s impossible to help people when they are not open and honest. As advisors we need to really understand our client’s situation so that we can develop a successful buy or sell strategy. Building a trusting relationship is critical.

In our last post we discussed motivation as a key factor in qualifying Buyers and Sellers of businesses. The next step in qualifying both Buyers and Sellers is their financial resources and requirements. Sometimes we feel like therapists trying to understand a person’s goals, desires, dreams, and pains, but this is necessary in order to understand the emotions and financial needs driving decisions.

Buying

Dreams and goals are great, but when buying a business, one has to have financial resources to get started. If we try to help someone buy a million dollar business because it matches their dream, we need to make sure the buyer actually has funds for the initial down payment and working capital.

If funds aren’t there for a $1 million dollar purchase, maybe we need to adjust the dream to start at a more realistic $250,000 (for example). In all cases, the math needs to work to:

1. pay a loan,

2. provide the buyer their required income, and

3 still leave cash to operate the business.

It is easier to reach that ultimate goal if we don’t start out with a situation doomed to fail!

Selling

On the sell side, we need to make sure that the value of the business matches the seller’s expectation and that there will be money to fund retirement or their next project. If the market value doesn’t appear to be enough, we need to rethink the timing of the sale or reassess the seller’s real financial need post-sale. Sometimes a discussion with a good financial advisor will help identify a person’s actual retirement needs.

There may be other obligations that we should be aware of, for instance: tax or other liabilities weighing on the seller, family and estate issues, partnership difficulties, etc. These are stressors that can impact the seller’s financial picture but don’t change the value of the business. So, need does not equal value, but the need helps us develop a strategy for a transition. If we don’t know, it is hard for us to help.

Get some assistance from your Apex Business Advisor!

Doug Hubler

President

Uncovering an individual’s motivations to buy or sell businesses can be extremely challenging because they either want to keep it a secret or they just aren’t sure themselves.

Uncovering an individual’s motivations to buy or sell businesses can be extremely challenging because they either want to keep it a secret or they just aren’t sure themselves.

We had a couple successful closings today, but one stands out because of the positive experience that could be relevant when dealing with your own transaction.

We had a couple successful closings today, but one stands out because of the positive experience that could be relevant when dealing with your own transaction. When I read

When I read  Selling and Buying businesses is different than completing real estate transactions. With a real estate transaction a price is agreed to, probably an appraisal is ordered, and maybe an inspection, but there is very little due diligence required. When selling a business there is quite a bit more involved in the due diligence process, financing options, business valuations, legal documentation, and so on.

Selling and Buying businesses is different than completing real estate transactions. With a real estate transaction a price is agreed to, probably an appraisal is ordered, and maybe an inspection, but there is very little due diligence required. When selling a business there is quite a bit more involved in the due diligence process, financing options, business valuations, legal documentation, and so on. Welcome

Welcome